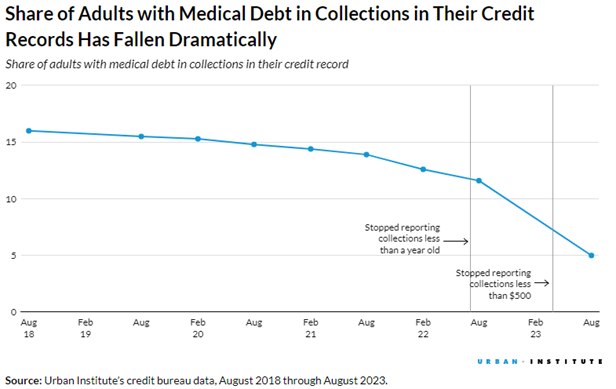

By this point you’re certainly aware of the changes around the credit reporting of medical debt, which to recap are:

- Medical debts that have been satisfied will no longer appear on credit reports

- The amount of time before medical debt can be reported to the credit bureaus has doubled, from 180 days to one year

- Medical debt in collections of under $500 dollars will no longer appear on credit reports

As the graph below shows (courtesy of Urban Institute); this has had the intended effect of clearing up a lot of consumers’ credit reports. However, these credit reporting changes will certainly impact the ever-shrinking margins of healthcare providers. With the possibilities for further restrictions or even complete removal from credit reports in the future, it is paramount that healthcare providers continue to optimize their revenue cycles.

Areas with Optimization Potential

- Improved front-end patient financial planning

-

- Price Transparency: Provide patients with clear estimates of costs before procedures to avoid surprise bills.

- Financial counseling: Offer guidance on insurance coverage, payment options, and potential financial assistance programs.

- Flexible payment plans: Develop plans with lower monthly payments that are easier for patients to manage.

- Streamlined billing and collections

- Invest in technology: Utilize tools for accurate coding and claims submission to minimize denials and rejections.

- Automated billing systems: Automate routine tasks to free up staff time for more complex issues.

- Efficient communication: Clearly communicate billing details and options to patients early and consistently.

- Focus on patient engagement

- Simplify billing statements: Make bills easy to understand with clear breakdowns of charges and explanations of codes.

- Multiple payment channels: Offer online payment options, phone payments, and in-person options for convenience.

- Patient portals: Provide secure online access for patients to view statements, manage bills, and communicate with billing staff.

- Exploring alternative revenue cycle models

- Bundled payments: Partner with insurers for bundled payment arrangements for specific procedures.

- Charity care and financial assistance programs: Develop clear guidelines and applications for charity care and financial assistance programs to help low-income patients.

The Future of Healthcare Bad Debt

As mentioned earlier in this post, no one can be sure what the future holds for the possibility of further credit reporting restrictions. Now more than ever, bad debt collection is something maximized not by brute force, but rather the use of soft skills and a human-centric approach.

Agencies typically have similar technological capabilities and are all working with the same constraints. Therefore, those focused on providing empathetic service not only perform better but serve to maintain the patient/provider relationship. “Today’s collection call is tomorrow’s patient” should be the mantra of your collections vendor.

Our Final Word

By focusing on preventative measures, leveraging technology and prioritizing patient communication, healthcare providers can adapt to the constantly shifting landscape of medical debt collections. Overall, the trend is clearly moving away from using medical debt as a factor in credit scores.

If your bad debt collections have been decreasing since these changes were enacted, review your vendor’s process with a go-forward focus on soft skills. We welcome conversation around how we’ve addressed the changes to credit reporting and be sure to ask about our FREE staff training classes such as “Disarm with Charm”, “Master Communicator” and “Hostile to Hopeful”.