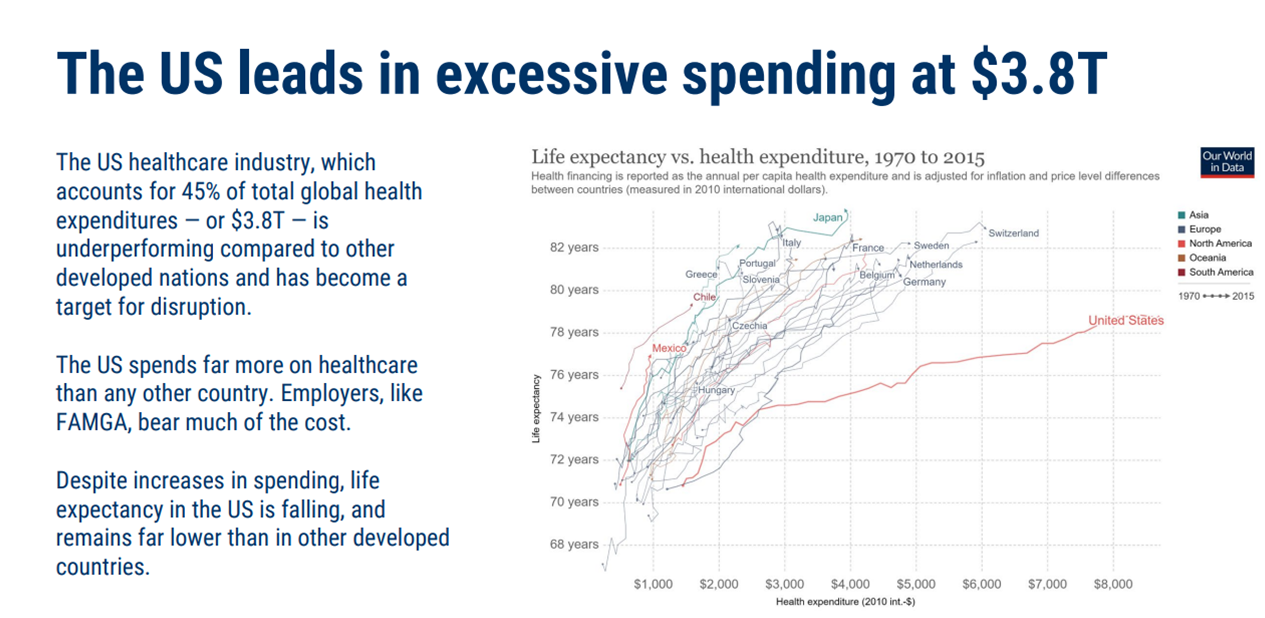

Make no mistake, the healthcare industry is rife for new entries across a wide span of verticals and corporate America has taken note. This is due to the cost burden crushing consumers and employers alike; and is a natural extension of the increased consumerism patients have been exhibiting for years. The image below does a great job highlighting just what makes the marketplace so appealing to the largest corporations:

Image Source: CBINSIGHTS, “The Big Tech in Healthcare Report”, 2021

As to specifics of what is driving big companies into the healthcare market, this report shares the following list:

- Consumerism

- Explosion of health data

- Demand for AI & automation

- Enterprise interest in smart devices

- Healthcare’s cost burden

There’s clearly money to be made; be it in the form of offering technical solutions for providers, “wearables” such as smart watches and VR, or the outright offering of healthcare services. The need for providers to optimize revenue is nothing new but the threat of corporate interests as competition most certainly is.

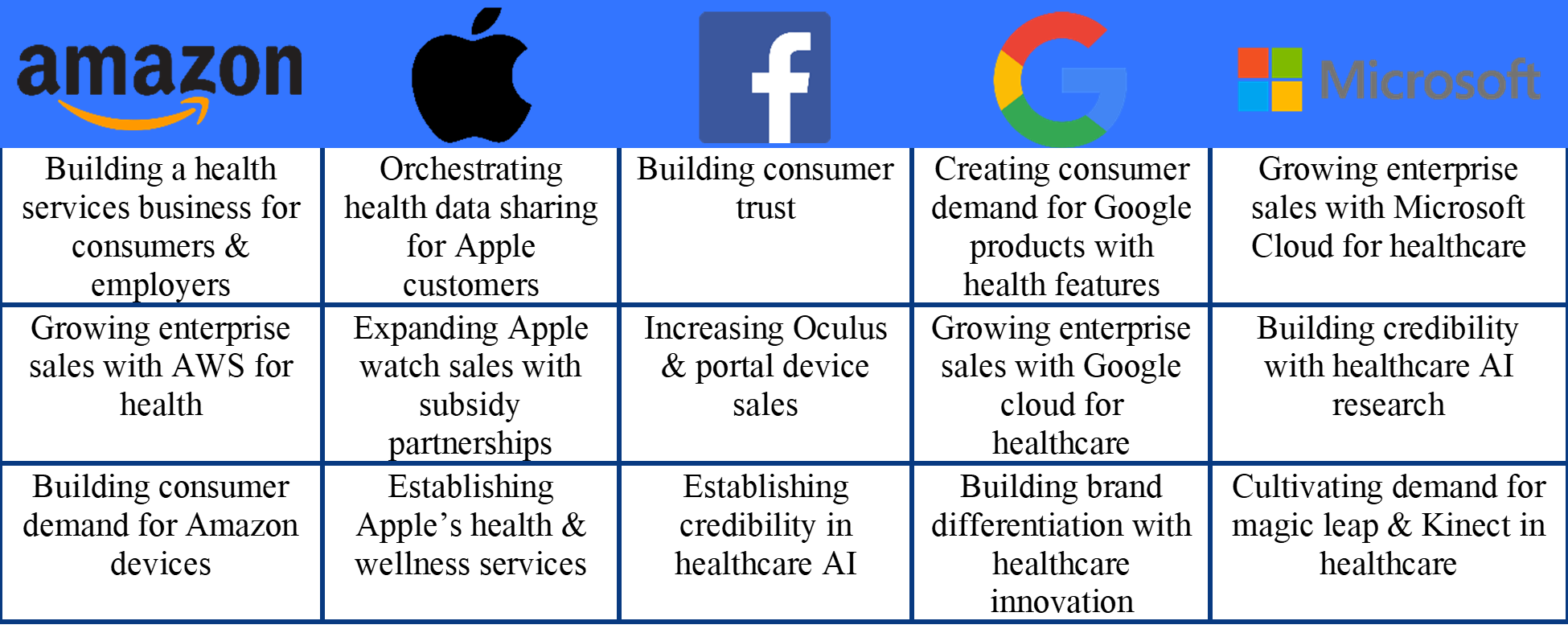

The Fearsome Five

Amazon, Apple, Facebook, Alphabet (Google) and Microsoft. Five wildly successful conglomerates whose combined valuation is at least 7.5 TRILLION dollars. With those kinds of resources at their disposal and an inclination to enter the industry, it would behoove healthcare leaders to closely monitor their activity. In some instances, their movements do not equate to direct competition; as in the case of wearable tech or AI/automation.

However, they absolutely have an eye towards capitalizing on patients’ exhaustion with their cost burden, combined with the increased accessibility options driven forward by COVID (such as telehealth). “Omnichannel” was the key word bandied about the HLTH Conference in the fall of 2021. As it relates to the newest entries into healthcare, their focusing on omnichannel delivery simply means they’ll meet the patients where they are. This includes:

- In-person care

- Virtual care

- Care at home

- Care by mail

Beyond the attractiveness of patients being able to further dictate their care, offerings with that breadth of delivery will increase efficiency and reduce cost…something that will serve to bolster their viability beyond their vast resources. The table below was created with data from this report and shows each company’s top three areas of focus as they relate to their moving forward in healthcare.

CVS – the Newest IDN?

Per CVS’s CMO Dr. Sree Chaguturu, CVS becoming a significant hub during the COVID 19 pandemic helped them refine their approach to in-person care offerings. He was also quoted as saying “As we move into virtual care, we believe virtual care is a connection of virtual visits, plan design, and physical infrastructure, and you need that physical backstop, and that 10,000 retail locations across the country is a pretty compelling backstop.”

Unconvinced? You shouldn’t be, as CEO Karen Lynch outlined her strategy to Fortune. She looks at the thousands of neighborhood pharmacies and sees a potential reshaping of primary care, with CVS boasting the ability to serve thousands of patients daily. “We’ll be far more than the corner drugstore,” says Lynch. “We’re pivoting to become more central to America’s healthcare.”

Our last blog post touched on inflation while addressing the staffing crisis – healthcare providers are truly under siege.

Revenue Cycle – Optimize, optimize, OPTIMIZE!

Declining profit margins and growing expenses, a truly dastardly duo of phrases! We sometimes feel like a broken record when it comes to highlighting the necessity of revenue cycle optimization, but it has never been more important to the industry. Some providers are boosting their finances with investments, including stocks or by merging with other systems, which certainly cannot hurt. However, those financial boosts solve nothing if there are unknown revenue cycle issues undermining their performance. Whether through renewed internal focus or via outsourcing, the revenue cycle should be examined and tweaked to ensure maximum performance.

We’re Here if you Need us!

We’ve been focused on giving healthcare providers peace of mind with their revenue cycles for over 30 years. While healthcare-focused bad debt collections are our flagship offering, we can provide EBO services including all aspects of patient communication, as well as patient responsibility collections including payment negotiations. Your patients’ dignity and respect is our focus and customer service is in our DNA.

Call 888.576.5290 or just shoot us a message to arrange a free phone consultation around your schedule – we’re always happy to talk through any revenue cycle concerns!